5-day in-person training

Advanced Project Finance Theory & Modelling

20-24 Jan 2025

20-24 Jan 2025

09:30 - 17:30 CET

09:30 - 17:30 CET

Amsterdam, the Netherlands

Amsterdam, the Netherlands

Mastering financial modelling often takes years. But not anymore. In 5 days, you’ll master the skills to tackle complex project finance deals. Learn techniques refined by industry experts over decades. Gain practical knowledge to excel in structuring and modelling projects—transforming you into the expert your team trusts with multi-million-dollar decisions.

Pricing: €5,808 €4,646.40 (Early bird - Ends Dec 6th)

Don’t miss out. Only 16 places available.

We've trained the world's leading institutions

5-day in-person training

Course overview

Unlock the complexities of financing large-scale projects with our "Advanced Project Finance Theory & Modelling" course.

Dive deep into sophisticated financial models and theoretical frameworks that underpin successful project financing, focusing on the burgeoning field of energy transition. As the world pivots towards sustainable energy solutions, professionals equipped with advanced Project Finance skills are in high demand.

This comprehensive course offers you the expertise to navigate and capitalise on the abundant career opportunities within the energy transition sector. Join us to enhance your skillset, drive sustainable projects, and accelerate your career in one of the most dynamic and impactful areas of global finance.

Learn from 3x industry experts

Gain decades of knowledge in 5 days

CPD accredited course

What’s included?

This course is designed for Project Finance lenders, advisors, modellers, investors and project developers, as well as public sector project procurement teams.

Five days in-person training with industry leaders, Kenny Whitelaw-Jones, Ed Bodmer and Hedieh Kianyfard

All working files

A free digital copy of Kenny’s Financial Modelling Handbook

Coffee, tea and biscuits throughout the day

Certificate of attendance

What you’ll learn:

01. Foundation in Project Finance

Gain a solid foundation in the essence and principles of project finance to use in assessing effective structures and financial parameters.

02. Financial Modelling Techniques

Apply financial modelling principles to risk analysis and risk mitigation using structured, transparent, and flexible modelling techniques.

03. Economic & Contract Structuring

Understand economic and contract structuring issues in project finance through mini case studies including a wind farm resource analysis.

04. Debt Sizing & Repayment Profiles

Become comfortable with debt sizing, repayment profiles, debt funding, interest rates, fees, and protections like DSRA, covenants, etc.

05. Contracts & Negotiating Terms

Learn nuances of contracts and negotiating terms for PPA, EPC, and O&M contracts, including liquidated damages, bonuses, and penalties.

06. Upsides for Investors

Understand the upsides for investors in project finance, from re-financing, selling assets, and using development fees to allocate risks.

07. Participate in Case Study

Participate in a wind facility case study where groups take on different roles and negotiate to establish a bid with a re-structured price.

Best in the business

“Kenny's as engaging and lovely as he comes across on the videos and really, really well informed. This is not someone who specialises in training. He specialises in Project Finance modeling and using models to answer investment decisions."

Max Peile - Senior Principal Consultant

Get the course brochure

Download the brochure for a full breakdown of the course content, expert trainers, and how this 5-day experience will equip you with advanced project finance skills.

Training requirements

This course is designed for Project Finance lenders, advisors, modellers, investors and project developers, as well as public sector project procurement teams.

Please bring a laptop with Microsoft Excel for Windows installed, along with any necessary leads and adapters if you're travelling from abroad.

Participants should have basic financial modelling skills, including the ability to create a 3-statement model and familiarity with key Excel functions.

Note, this course is delivered in English.

Course Schedule

Advanced Project Finance Theory & Modelling

Get hands-on training with industry leaders and elevate your skills to new heights. Join us and take your financial modelling expertise further.

Hands on trainers

"Hedieh’s practical teaching, backed by real project experience in Africa, helped me build my first model for a wind farm in sub-Saharan Africa. Her tailored approach deepened my understanding, and regular feedback improved my Excel skills and professional growth."

Ndiengoudy Ibrahim Sall - Associate Investment

About your trainers

Kenny Whitelaw-Jones

Partner, Gridlines - Author, Financial Modelling Handbook

Kenny has spent the last 20 years in financial modelling both in delivery of financial modelling assignments in training of financial modelling professionals. He has trained thousands of modellers from the world’s leading commercial and investment banks, top-tier accounting firms, infrastructure funds and developers.

Hedieh Kianyfard

Author, Financial Model Detective

Hedieh Kianyfard has numerous years of experience as a financial modeller. She has been involved as the lead financial modeller in several infrastructure projects in Africa. She has worked as the program manager and lecturer in a number of executive training programs on Investment Appraisal and Risk Analysis.Hedieh Kianyfard is also the author of Financial Model Detective: Hints and tricks for review of financial models.

Ed Bodmer

Financial Modeller and Student of Finance Theory and Practice

Edward Bodmer is a world leader in financial modelling, valuation analysis and evaluation of renewable energy including storage and hydrogen technologies. He has been an advisor for many large projects around the globe and he has taught hundreds of courses on an assortment of energy analysis and financial modelling topics.

About your venue

Your Venue

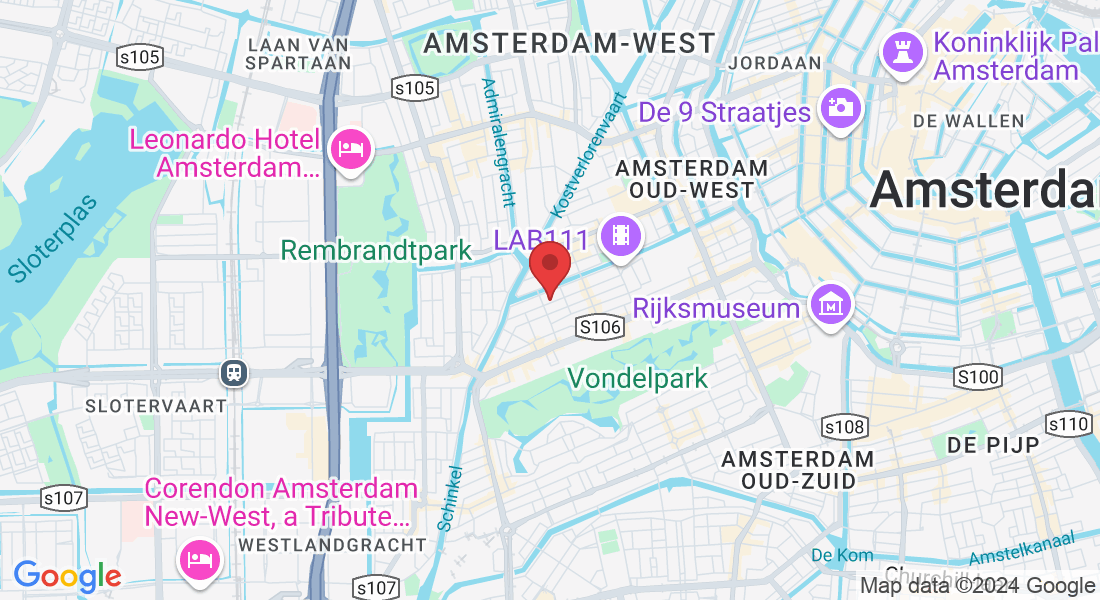

Creative Point, Amsterdam,

The Netherlands

The Masterclass is in Amsterdam Oud-West, near the Van Gogh museum, in a cozy meeting room with an outdoor terrace and is easily accessible by public transport.

The Masterclass is in Amsterdam Oud-West, near the Van Gogh museum, in a cozy meeting room with an outdoor terrace and kitchen with catering options.

Frequently Asked Questions:

Who should attend this course?

This course is ideal for Project Finance lenders, advisors, modellers, investors, and project developers. It’s also valuable for public sector teams involved in project procurement.

What prior knowledge is required to attend?

Participants should have basic financial modelling skills, including the ability to create a 3-statement model and familiarity with key Excel functions.

How much does the course cost?

The regular course price is €5,808, or €4,646.40 with the Early Bird discount (available until December 6th). Teams of 2-5 receive a 10% discount, while teams of 5 or more enjoy a 20% discount.

What is included in the course fee?

The fee includes five days of in-person training, working files, a digital copy of The Financial Modelling Handbook, lunch, coffee, tea, biscuits, and a certificate of attendance.

Can I receive a discount for attending as part of a team?

Yes, there are team discounts: 10% off for groups of 2-5 people, and 20% off for groups of 5 or more. Group discounts do not apply during the Early Bird offer.

Advanced Project Finance Theory & Modelling

Get hands-on training with industry leaders and elevate your skills to new heights. Join us and take your financial modelling expertise further.

© 2024 Gridlines. All rights reserved